Ketua Pengarah Kastam Malaysia. Malaysia GST Reduced to Zero.

Freelance Accounting Services Home Facebook

22 Jalan SS 63 Kelana Jaya 47301 Petaling Jaya Selangor.

Malaysia kastam tax list. Sistem Levi Pelepasan MYDLV adalah salah satu sistem di bawah tadbir urus dan kawal selia Jabatan Kastam DiRaja Malaysia JKDM bagi melaksanakan pengurusan dan pemprosesan data dan aliran kerja bagi Levi Pelepasan. All the payment of sales tax in Malaysia can be made through the MySST system Financial Process Exchange FPX use cheque or bank draft to make payment. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. In order for the recipient to receive a package an additional amount of.

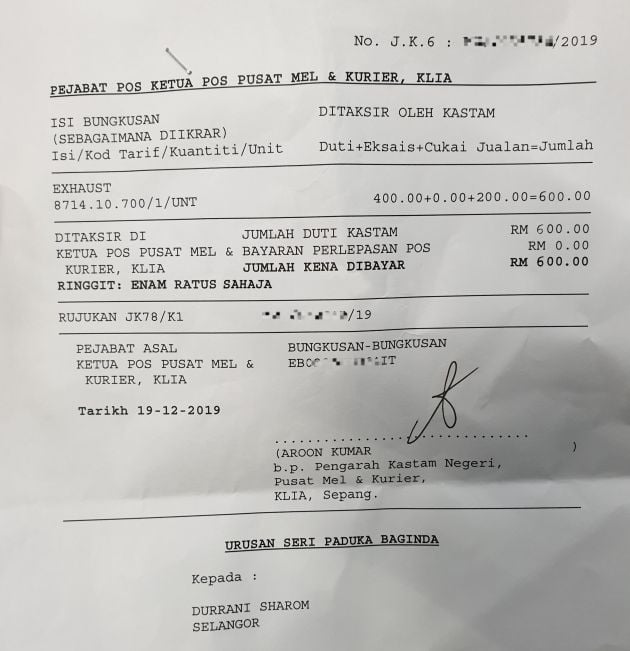

Incidental exempt supp ES43 GST. The import tax on a shipment will be. For GST Import cheque made will be payable to PENGARAH KASTAM NEGERI.

The existing standard rate for GST effective from 1 April 2015 is 6. Payment via chequebank draftmoney order must be made payable to Ketua Pengarah Kastam Malaysia and mail to. The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so.

Reducing the cost of doing business. Jabatan Kastam Diraja Malaysia Kompleks Kastam WPKL No. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. If your output tax exceeds the input tax the difference shall be remitted to the Government together with the GST returns not later than the last day of the following month after the end of taxable period. Any payment via cash is not accepted.

Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia. Adjustment to Input Tax. Jabatan Kastam Diraja Malaysia abbreviated RMC or JKDM is the Malaysian Government agency responsible for administrating the nations indirect tax policy border enforcement and narcotic offences.

COMPLAINT. Purchases GST not claimable GST. For more information regarding the change and guide please refer to.

Ketua Pengarah Kastam. HS Code Item Description. Cheque payable to KETUA PENGARAH KASTAM MALAYSIA GST Import should be paid according to normal importation payment procedure.

Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. Exported manufactured goods will be excluded from the sales tax act. Fiscal policy continues to support growth.

Commitment towards fiscal consolidation. Overview of Goods and Services Tax GST in Malaysia. Service tax a consumption tax levied and charged on.

NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10 Live Bee Lebah 0106 01. Page 2 of 130. Non- Service Tax registered person or Sales Tax registered manufacturer who is not registered for Service Tax would need to furnish the SST.

Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in Malaysia. Effective 1 January 2019 any person importing a taxable service into Malaysia for the purposes of business is required to file a return and pay the service tax in respect of the service imported. Except Supplies under GST.

The sales tax rate is at 510 or on a specific rate or exempt. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. In other words KDRM administers seven 7 main and thirty-nine 39 subsidiary laws.

Import and export of illicit drugs eg. Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0. Purchases exempted from GST.

GST Customs Malaysia Kastam Goods and Services Tax GST Malaysia guide in GST Training Course GST Customs Malaysia is ready with online system for GST tax submission and issuing. The Royal Malaysian Customs Department Malay. Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018.

The challenge for a business would be assessing the nature of the services it imports and determining whether they are taxable. Morphine heroine candu marijuana etc are strictly prohibited. In taxes will be required to be paid to the destination countries government.

Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. Debt as a percentage of GDP on a downward trajectory. For example if the declared value of your items is.

AGENCY Browse other government agencies and NGOs websites from the list. EVENT CALENDAR Check out whats happening. Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor.

The electronic acquisition system better known as ePerolehan will facilitate government procurement activities and improve the quality of services provided. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

Adjustment to Output Tax. In the run-up to Budget 2018 our Head of Indirect Tax Raja Kumaran discusses the need for a more resilient and sustainable GST system in Malaysia. THE PUNISHMENT FOR DRUG TRAFFICKING IS DEATH BY HANGING.

Apart from this KDRM implements 18 by. Service Tax registered person should be able to include the imported taxable services in the SST -02 return. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Custom Department to classify commodities when they are being declared at the custom frontiers by exporters and importers.

The SST consists of 2 elements. Incidental exempt supp TX-E43 GST.

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

No comments