Anda perlu menambah customsgovmy kepada emel pegawai bagi tujuan penghantaran. All sales and services tax payment can be made via electronic through the MySST Financial Process Exchange FPX system or manually by cheque posted to the Customs Processing centre.

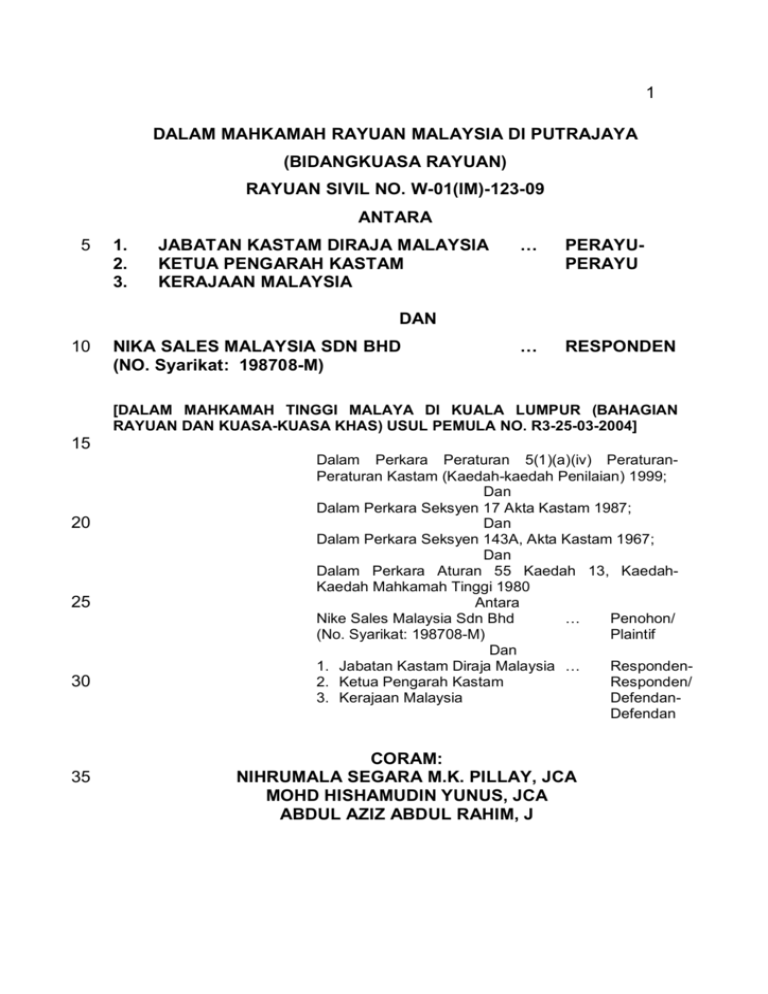

Rayuan Sivil No W 01 Im 123 09 Antara 1 Jabatan Kastam Dir

Kompleks Kastam Kelana Jaya.

Sales tax kastam. 5 Goods including basic foodstuffs building materials fruit juices personal computers mobile phones and watches. Jabatan Kastam Diraja Malaysia. Goods subject to 20.

47301 Petaling Jaya. Service Tax 1972018 1103. You can make your payment with.

47301 PETALING JAYA SELANGOR. The Sales and Services Tax SST has been implemented in Malaysia. Information of Local Purchase.

For corporate account payments B2B the amount is RM100 million. Online Cheque bank draft and posted to SST Processing Centre or to. Goods subject to 5.

The case concerns alleged underpayment of import duties and sales tax under the Sales Tax Act 1972 arising out of K1 Forms and official receipts reportedly falsified by the taxpayers. Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in Malaysia. HERE are many translated example sentences containing DUTY EXEMPTION - english-malay translations and search engine for english translations.

03 - 7804 5116. NO22 JALAN SS63 KELANA JAYA. In Malaysia she sales tax charged at 10 is the default sales tax rate.

Sales Services Tax 2018. The SST consists of 2 elements. Service tax a consumption tax levied and.

The first two charges were framed under Section 26 5 of the Sales Tax Act 2018 punishable under Section 26 9 of the same Act where the company as a taxable person allegedly failed to pay. PM - Budget 2015 Speech Text more See More. We offer you a range of convenient payment options.

For online tax payments there is a limit for the allowable amount. Payment Of Sales Tax. Lampiran C 1 ii Components.

Ketua Pengarah Kastam Malaysia. An approved person may download format of the Laporan CJ P Jadual A-MIDA via the MySST system. Akademi Kastam Diraja Malaysia AKMAL Bahagian Teknologi Maklumat.

Jabatan Kastam Diraja Malaysia. HS Code Item Description. The SST has two elements.

Any registered manufacturer to importpurchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax formerly CJ5. For payment of taxes online the maximum payment allowable is as follows. - Analyse the full set of account to recognize the revenue outflow.

Keep track of service tax that needs to be paid to Customs. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. The abovementioned additional sales tax was imposed as Kastam Putrajaya had issued a Customs Ruling on 4 July 2019 for seven 7 products 5 July 2019 for one 1 product and 9 October 2019 for two 2 products of HSPM that are to be treated as sweetened biscuits and the sales tax rate of 5 is applicable to the products.

-- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA. - Auditing companies account which subjects to GST to ensure the company account is complying with the GST Act 2014. Petaling Jaya Selangor Malaysia.

Malaysia Sales Sales Tax SST. Service Tax FAQ BM more Sales Tax FAQ BM more See More. Translations in context of DUTY EXEMPTION in english-malay.

No22 Jalan SS63 Kelana Jaya. Pelan Tindakan Strategik JKDM. Sales Tax Exemption Under Item 33A 33B 55 63 64 65 Schedule A Sales Tax Persons Exempted from Payment of Tax Order 2018 As at 25 June 2019.

Item 1 Schedule C. In Ketua Pengarah Kastam v CL Systems Sdn Bhd1 Customs appealed to the High Court against the CATs decision to set aside BODs issued by Customs. What are the sales tax rates.

Sales Tax is imposed on imported and locally manufactured taxable goods. 10 For other goods except for petroleum subject to specific rates and goods that are not exempted. A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and.

For corporate account payments the online transaction limit is RM100 million while for. PEJABAT PENOLONG KETUA PENGARAH KASTAM ZON TENGAH. Lampiran C 1 i Raw materials.

The incidence of tax is provided under section 22 of the Sales Tax Act 1972. The Laporan CJ P Jadual A-MIDA shall be filled in completely and sent to the SST Division of the controlling station at any time when purchase or importation of goods with sales tax exemption occurred. Download the respective format.

Sales Tax 10 On any taxable goods and imported taxable goods in Malaysia a single-stage sales tax is charged by the registered manufacturers. A detailed list of the taxable goods tax rates can be read here. Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia.

Goods subject to specific rate. The rates for sales tax are. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft.

The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments.